The use of computers in the banks is an effective method for reducing the time taken in the process and also reducing the cost incurred. The computer helps the banks to keep up with the changing demands that come up with technological advancement in society. The computers are less prone to error and provide accurate calculation and these characteristics are what makes computers better suited for the needs of banks.

What is the use of computer in banking?

- To enter and store account details & information

- To perform account calculation

- To communicate with other branches

- To generate account statements

- To give receipts to customer

- To scan and read the passbook

- To track and analyze customers

- To use online banking or Internet banking

- To trade in securities

- To provide customer service

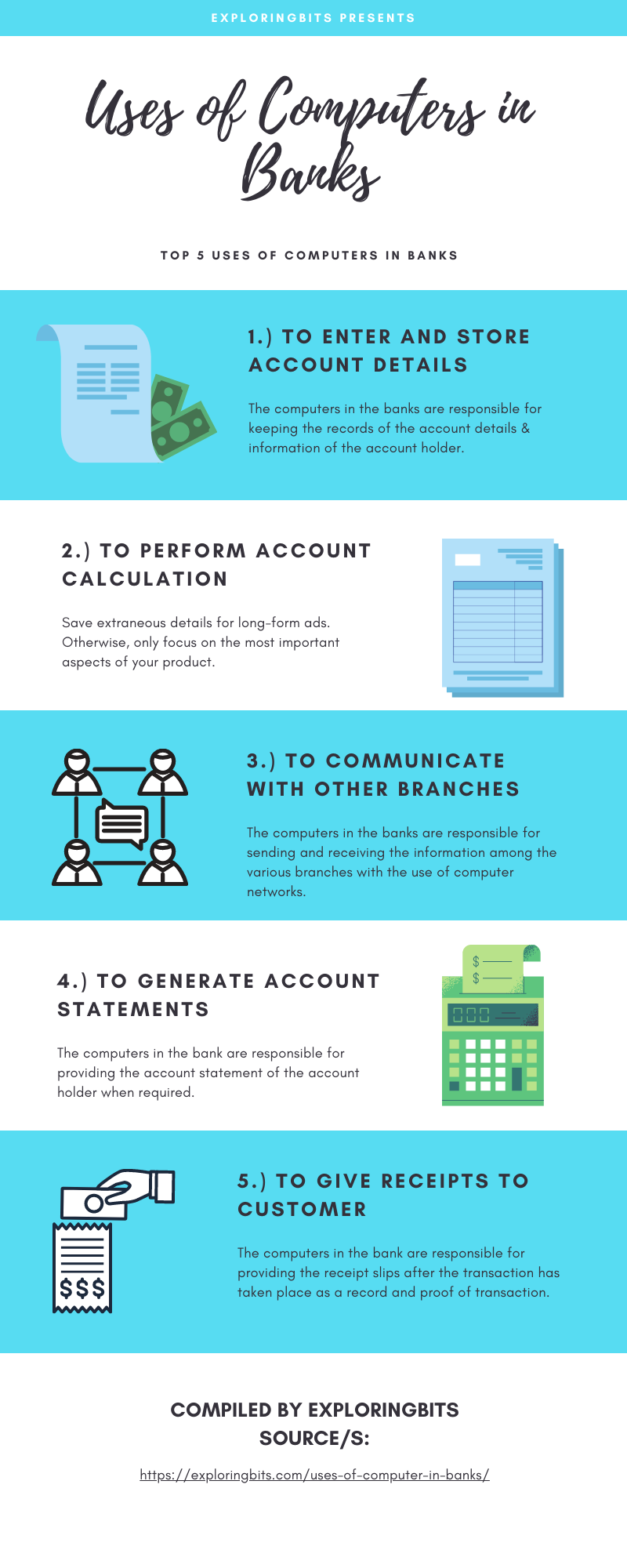

Top 5 Uses of Computer in Banks (Infographic)

The banking sector is one of the places where computers are integrating to assist the growth of industry. There are various uses of computers in different industries that increased their growth exponentially in less than a decade.

First let’s discuss Top 10 uses of computers in banks in greater detail.

To enter and store account details & information

The computers in the banks are responsible for keeping the records of the account details & information of the account holder.

There are many customers of the bank and utilizing the services that the bank provides can only be done when customers open an account in the bank. And to open an account some information is required of the account holder such as name, birth date, certification, type of account, etc.

All this information is stored inside the computer database. And the required information of the account holders is made available to the employees of the bank. They can request information about any account holder by typing the account number of the holder, and all the details that are related to that particular account in the bank will be displayed on the desktop screen of the employee.

To perform account calculation

The computers in the bank are responsible for account calculations that are required by the banks to be accurate and errorless.

There are various tasks in the bank that require computer calculation daily. This is also because computers are less prone to errors and miscalculations. Earlier when there were no computers the accounting was done on pen and paper by humans. And this would take an enormous amount of time for first calculating and then rechecking of the calculations and that too on paper records. The computer has reduced this burden and made accounting very simple and easy.

The task in the account calculation can involve calculating the interest that a person has to pay in a certain number of years after taking the loan, calculating the monthly installments that the loan taker has to pay, calculating weekly and monthly dues and paid statements, calculating the taxes to be paid, and many more.

The computers can calculate the various account related calculations accurately and timely with any human error. The only error faced in the calculation is when the bank employee has entered wrong or missed some digits.

To communicate with other branches

The computers in the banks are responsible for sending and receiving the information among the various branches with the use of computer networks.

When the bank starts to open its new branches at various locations within a city, then the bank shares a common database with all the other branches of the bank and this database contains the information about the employee or the customer of the bank.

The major advantage of sharing the information with other branches is that the customer can deposit or withdraw cash or perform any account-related task at any branch nearest to his/her location.

Also, within the bank, various tasks require communication with other bank branches. For example, if the main branch requests the information about the employees of the other branches and calculates the employee of the week by their performance then it will request the other branches of the bank to share information about their branch employees and with the help of computer networks, it will send this information to the main branch.

To generate account statements

The computers in the bank are responsible for providing the account statement of the account holder when required.

The account statements are the transaction activities of the account holder. The account statement will contain the expense and deposits of every money in the account of the respective account holder. These account statements are maintained in the computer databases, and they can be printed on the account holder’s passbook.

On a daily basis, there are thousands of transactions that are performed by the many accounts in the bank. The online payments that you did for purchasing items on Amazon are reflected in the account statements. Therefore these huge number of account statements can be recorded by automating the computer by the computer programs to record every transaction.

With millions of transactions, every day and recording these transactions for generating the account statement was only possible by the computers and their capability to handle data with utmost accuracy.

To give receipts to customer

The computers in the bank are responsible for providing the receipt slips after the transaction has taken place as a record and proof of transaction.

For example, ATMs generate receipt slips. When the amount has been transacted on the ATM there is an option to print the receipt slips or cancel the print slip. If you accept the print receipt slip then the computer copies the records of the transaction that you performed and the amount of the cash remaining in the bank and then prints on the continuous series of paper which the customer has to pull from the machine. These receipts are proofs of the transaction and can be used in required situations.

Besides ATMs, there are many places where the receipts are generated by the computers within the bank also. For example, the account summary follows the same procedure as the ATM receipts where the customer can request the bank employee to print the past account transaction activity and the employee simply inserts the passbook of the customer in the printing device connected with the computer and then the operation is performed.

To scan and read the passbook

The computers in the banks are responsible to read the encoded characters in the passbook of the account holder.

There is a special input device that is known as a magnetic ink character reader (MICR) and this is attached to the computer systems. Whenever the account holder has to deposit cash to the account then the bank employees ask the customer for his passbook. The employee then scans the passbook and types the specific amount of cash that the account holder has to deposit. Then the account holder hands over the physical money and the employee proceeds to the transaction.

The above procedure is done completely on the computer from reading the encoded characters from the passbook of the customer to depositing the cash in the account holder’s name.

To track and analyze customers

The computers in the banks are also responsible to track, analyze and report the customers if the dues are paid, funds are sufficient, etc.

The account number provided by the bank is unique to every customer. As the data are stored in the computer, the computer programs can be easily designed to track the activity of every customer. The computer programs are automated such that any transaction that occurred in the account will be processed by these programs. Mainly such large-scale automation is done to track if sufficient funds are available in the customer accounts to pay the next due installment, or it can notify the customer if the amount in the account has fallen below the minimum limit, etc.

To use online banking or Internet banking

The computer networks are responsible for the transaction to take place with the help of a particular financial institution website.

With online banking, all the financial transactions that the customers were required to perform at the physical location can be done by using the websites that are prepared by the bank.

Many banks do not exist in the physical location and instead, they directly operate through these online banking mechanisms.

All these operations on the financial institution website can not be done without computers and the internet. First, secured computer servers are required to keep the user data secure and then the internet is required to access this website and again the computer application is required to access the site and perform transactions.

There is a completely separate branch of computers to handle the banking operation known as the transactional DBMS. In this branch, students are taught how databases and servers operate within the bank so that complete operation of the transaction takes place.

To trade in securities

The computers in the banks are involved in the real-time trading of securities and bonds that the banks offer.

The bonds and securities are the media for the customers to invest their surplus money in the market. When the customer invests in the bonds and securities then get a return on investment (ROI) on basis of interest.

In simple terms, these are opposed to taking loans. In loans where the customers pay for money borrowed from the banks whereas in investments the bank has to pay the interest to the customers.

These banks regulate the investment done by the customers by software applications that it provides to customers as well as to employees for tracking and analyzing.

Also, online banking plays an important role in trading where the customer can directly invest in the bonds and securities by the financial institution website. Also, online banking helps the investor to track their investments, and also the investors can withdraw their money invested in the banks with online banking.

To provide customer service

The computer enables the bank to provide customer services by using chat portals present on the online banking website.

In this chat portal, the customer can write the problems that he is facing and on the other side of the chat portal, the trained employee can provide the solution to the problems of the customers.

This chat portal customer service is equivalent to the real-time services that the bank offers.

FAQ (Frequently Asked Questions)

What are the uses of banks?

The uses of banks are – provide places to keep the cash, offer interest on the savings, provide loans to people, provide mortgages or home loans.

How computers are used in the banking sector?

The computer is used in banking sectors for online banking, accounting, tracking and analyzing transactions, providing online customer service, trade-in securities, and bonds, keeping the records of the account details, etc.

Aayush Kumar Gupta is the founder and creator of ExploringBits, a website dedicated to providing useful content for people passionate about Engineering and Technology. Aayush has completed his Bachelor of Technology (Computer Science & Engineering) from 2018-2022. From July 2022, Aayush has been working as a full-time Devops Engineer.